Pierre Beau 20-621-751

This podcast depicts why and how multinationals use the current international tax environment and competition between states to shift their profits from high tax to low tax countries. It especially focuses and explains the mechanisms of one instrument of profit shifting transfer pricing. Finally, it shows using how the international community successfully launched the BEPS Project in 2015 tackling transfer pricing issues with extracts of an interview of Pascal Saint-Amans, Director of the Center for Tax Policy and Administration of the OECD (cf sources below).

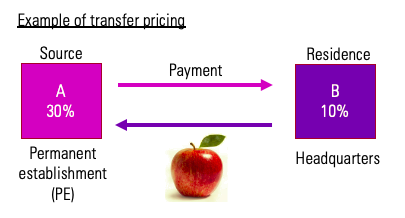

Illustration designed by the author.

Recent Comments